The Best Guide To Feie Calculator

Table of ContentsHow Feie Calculator can Save You Time, Stress, and Money.The Basic Principles Of Feie Calculator The Main Principles Of Feie Calculator The Greatest Guide To Feie CalculatorSome Known Factual Statements About Feie Calculator The 15-Second Trick For Feie CalculatorThe Best Strategy To Use For Feie Calculator

As a whole, U.S. people or permanent legal locals living abroad are qualified to claim the exemption. The amount of the exclusion is changed yearly based on the rate of inflation. The quantity of exemption for existing and previous tax years is as complies with:2015: $100,8002014: $99,2002013: $97,6002012: $95,100 In addition to this revenue exemption, the taxpayer may additionally qualify to omit the worth of employer-provided meals, lodging and certain additional benefit.To start with, federal government staff members are usually ineligible for the international income exemption even if they are living and functioning in an international country. A 2 year-old D (https://www.startus.cc/company/feie-calculator).C. Circuit Court decision, Rogers v. Commissioner, might place the worth of the foreign earnings exclusion in risk for thousands of migrants. Rogers entailed a U.S

The Feie Calculator Diaries

The exact same policy would relate to a person who deals with a ship in global waters.

The Foreign Earned Earnings Exemption (FEIE) allows qualifying united state taxpayers to omit as much as $130,000 of foreign-earned income from U.S. federal revenue tax (2025 ). For numerous migrants and remote workers, FEIEs can imply significant savings on U.S. tax obligations as foreign-earned income could be based on dual taxation. FEIE jobs by excluding foreign-earned income approximately a specific limit.

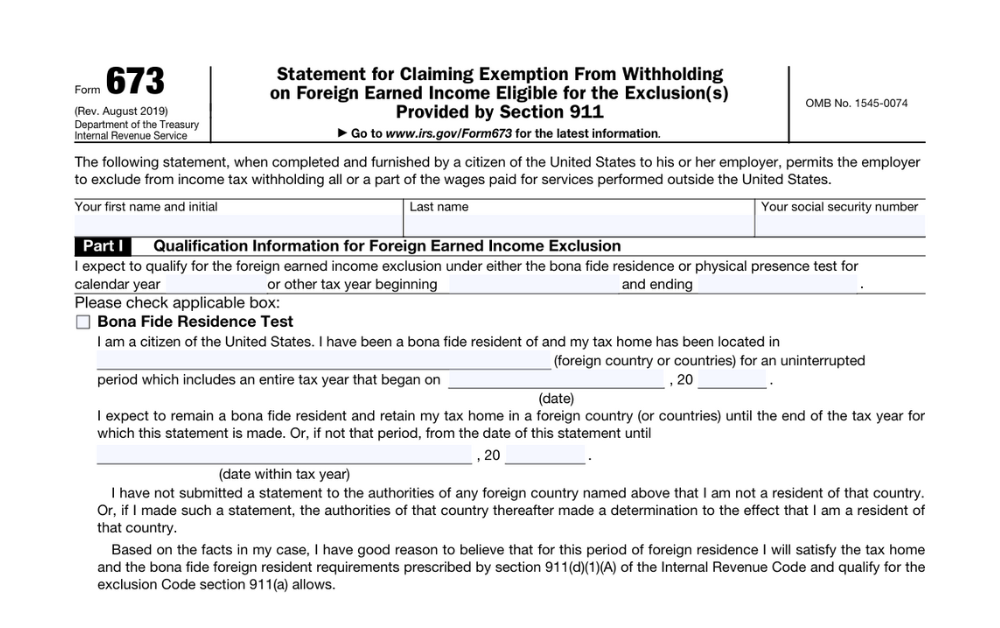

In contrast, passive income such as passion, dividends, and capital gains do not get exemption under the FEIE. Specific qualification tests require to be satisfied in order for migrants to receive the FEIE provision. There are two primary tests to determine qualification for the FEIE: the Physical Presence Examination and the Authentic Home Test.

Facts About Feie Calculator Revealed

taxpayer should invest at least 330 days outside the U.S. within a consecutive 12-month duration. The U.S. taxpayer have to have foreign-earned earnings. This united state taxpayer must have a tax obligation home in a foreign nation (with a tax obligation home defined as the location where an individual is taken part in work). There are obstacles that featured this test, nevertheless, especially when it pertains to tracking time abroad.

It's recommended that individuals make use of traveling trackers or apps that permit them to log their days spent in different locations, ensuring that they fulfill the 330-day requirement. The United state taxpayer need to have a tax obligation home in a foreign nation.

taxpayer has to have been an authentic citizen of a foreign nation for at the very least one tax year. "Bona fide local" condition needs demonstrating long-term foreign living with no brewing return to the U.S. Trick indicators of this condition might consist of lasting housing (whether leased or had), regional financial institution accounts, or acquiring a residency visa.

A Biased View of Feie Calculator

For couples, both partners will need to fill out a different Kind 2555, even if they're submitting tax obligations jointly. To finish a 2555 type, you'll require to: Select in between the Authentic House Examination and the Physical Visibility Test Record all international traveling to and from the United States during the tax obligation year.

Mark determines the currency exchange rate (e.g., 1 EUR = 1.10 USD) and converts his salary (54,000 1.10 = $59,400). Considering that he lived in Germany all year, the percentage of time he stayed abroad throughout the tax is 100% and he goes into $59,400 as his FEIE. Mark reports total incomes on his Kind 1040 and goes into the FEIE as an adverse quantity on Set up 1, Line 8d, minimizing his taxed income.

The 9-Minute Rule for Feie Calculator

Selecting the FEIE when it's not the very best choice: The FEIE may not be excellent if you have a high unearned income, gain greater than the exemption restriction, or stay in a high-tax country where the Foreign Tax Obligation Credit History (FTC) might be a lot more valuable (Foreign Earned Income Exclusion). The Foreign Tax Obligation Credit Score (FTC) is a tax obligation decrease approach frequently made use of together with the FEIE

deportees to offset their U.S. tax financial debt with foreign earnings tax obligations paid on a dollar-for-dollar reduction basis. This means that in high-tax nations, the FTC can typically eliminate U.S. tax obligation debt totally. Nonetheless, the FTC has restrictions on qualified taxes and the optimum claim amount: Eligible tax obligations: Only revenue taxes (or tax obligations instead of revenue tax obligations) paid to foreign federal governments are qualified.

tax obligation liability on your foreign earnings. If the foreign taxes you paid surpass this limitation, the excess foreign tax can generally be continued for up to 10 years or carried back one year (using a changed return). Keeping exact records of international revenue and tax obligations paid is for that reason crucial to computing the correct FTC and preserving tax obligation compliance.

Feie Calculator Can Be Fun For Anyone

expatriates to minimize their tax obligation liabilities. If an U.S. taxpayer has $250,000 in foreign-earned revenue, they can omit up to $130,000 making use of the FEIE (2025 ). The remaining $120,000 might after that go through tax, yet the U.S. taxpayer can potentially use the Foreign Tax obligation Credit history to offset the tax obligations paid to the international nation.

If he 'd regularly traveled, he would certainly instead complete Component III, detailing the 12-month duration he fulfilled the Physical Existence Test and his traveling history. Action 3: Coverage Foreign Income (Part IV): Mark earned 4,500 per month (54,000 each year).

The Best Guide To Feie Calculator

Selecting the FEIE when it's not the most effective alternative: The FEIE may not be perfect if you have a high unearned earnings, make even more than the exemption restriction, or live in a high-tax nation where the Foreign Tax Obligation Credit Report (FTC) may be a lot more valuable. The Foreign Tax Obligation Debt (FTC) is a tax obligation reduction strategy typically used along with the FEIE.

expats to offset their U.S. tax obligation debt with foreign earnings tax obligations paid on a dollar-for-dollar reduction basis. This indicates that in high-tax countries, the FTC can commonly remove U.S. tax debt totally. The FTC has constraints on qualified taxes and the maximum case quantity: Qualified taxes: Only income tax obligations (or taxes in lieu of income taxes) paid to foreign federal governments are qualified.

tax obligation on your foreign income - https://243453048.hs-sites-na2.com/blog/feiecalcu. If the foreign taxes you paid surpass this limitation, the excess international tax obligation can usually be carried ahead for approximately 10 years or carried back one year (using a modified return). Maintaining precise documents of foreign income and tax obligations paid is for that reason vital to calculating the correct FTC and keeping tax compliance

expatriates to lower their tax liabilities. If a United state taxpayer has $250,000 in foreign-earned revenue, they can exclude up to $130,000 utilizing the FEIE (2025 ). The continuing to be $120,000 may after that be subject to taxation, yet the united state taxpayer can possibly use the Foreign Tax obligation check here Credit score to offset the tax obligations paid to the international nation.